AI-Operated Accounting & Finance

Your entire finance function. Inside Claude.ai.

No separate app needed. Artifi gives Claude the skills to handle everything from bills to VAT returns — stored in an auditable, SOX-ready database.

01 — Work in Claude

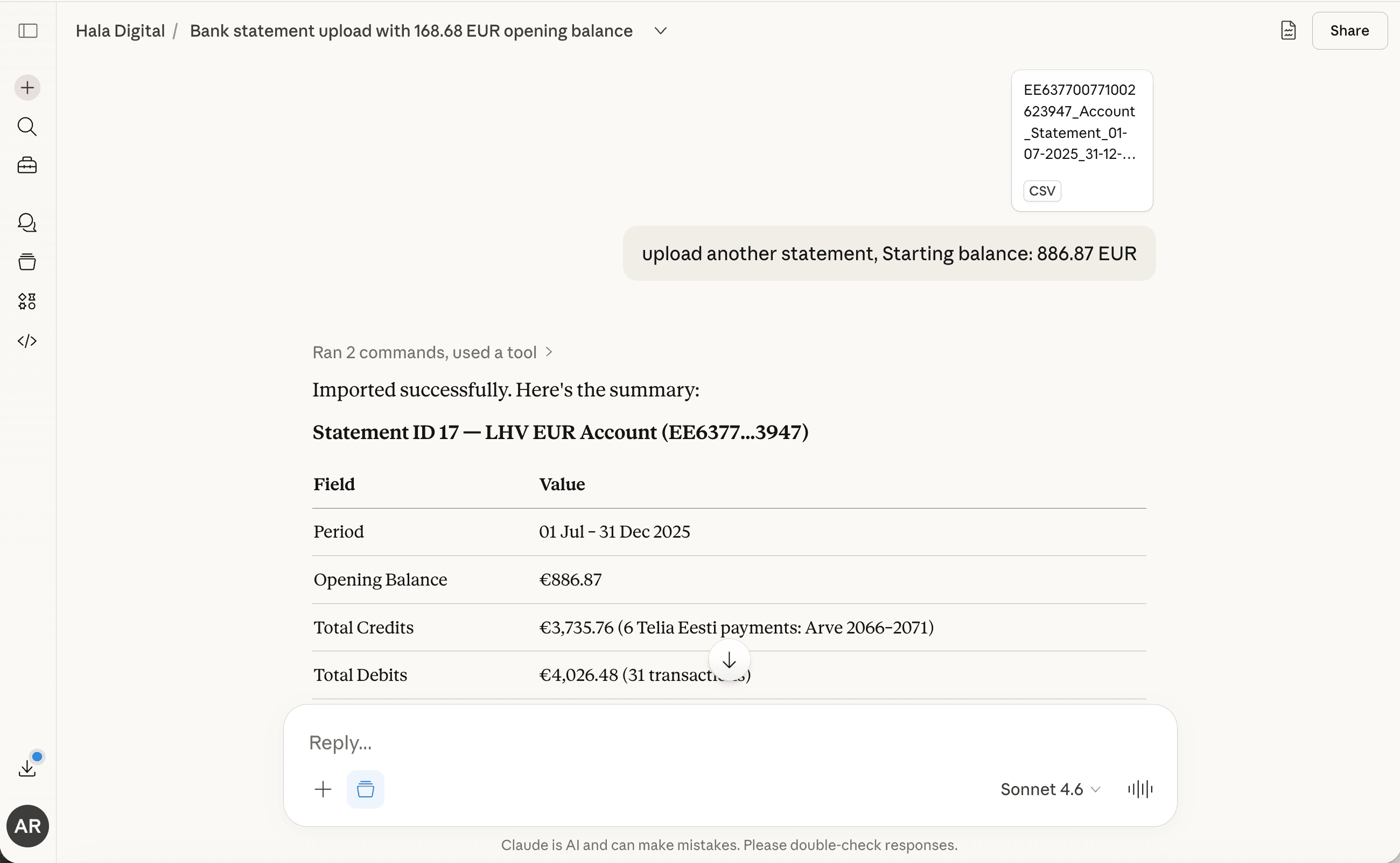

Do your work in Claude.ai

Upload bank statements, record invoices, ask questions about your finances — all in a natural conversation with Claude. No new interface to learn.

02 — Claude Skills

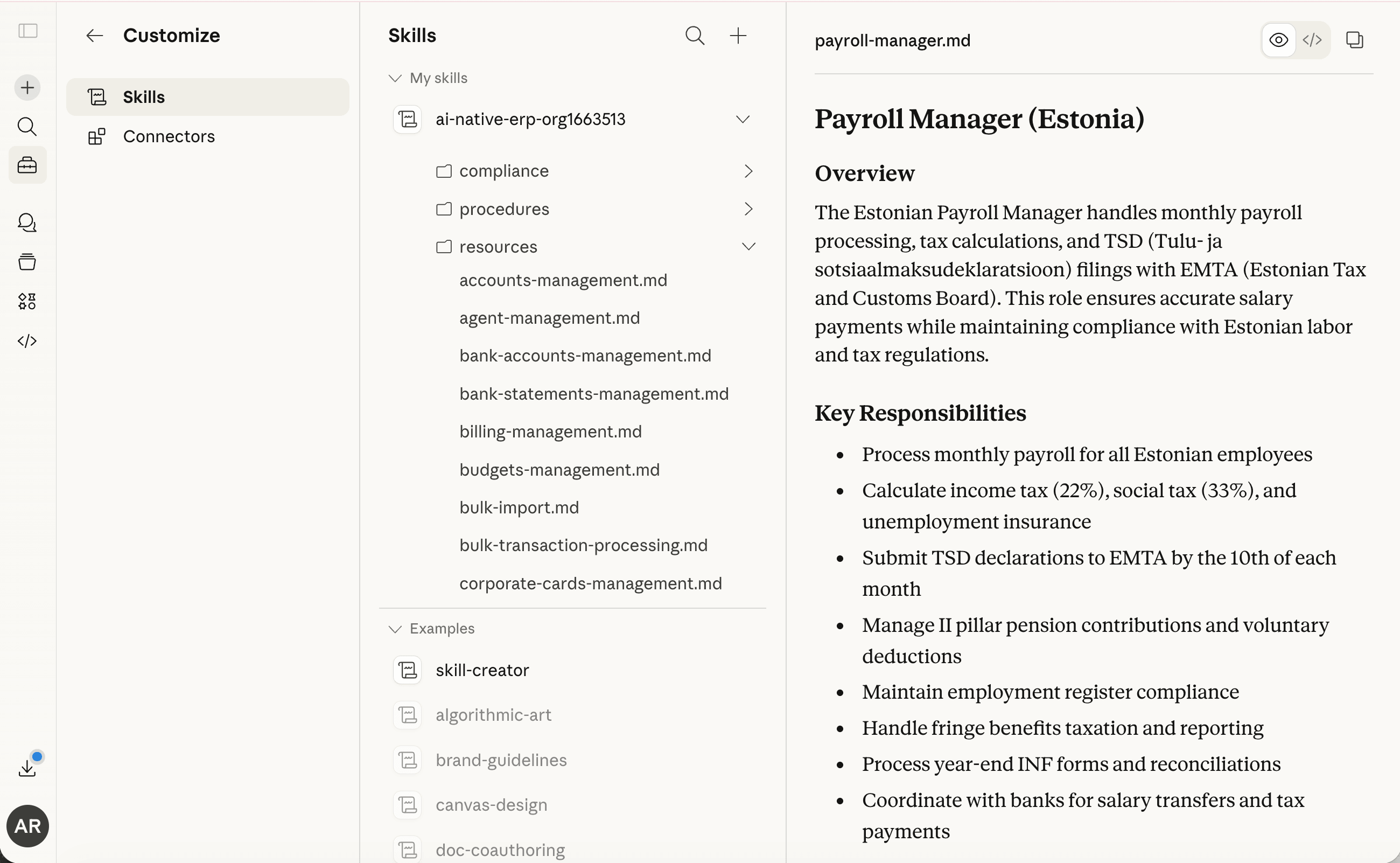

Do your work with Claude Skills

Artifi installs as a Claude Skill — giving Claude deep knowledge of accounting rules, your chart of accounts, vendor records, and transaction workflows. Claude becomes your finance expert.

03 — Excel Integration

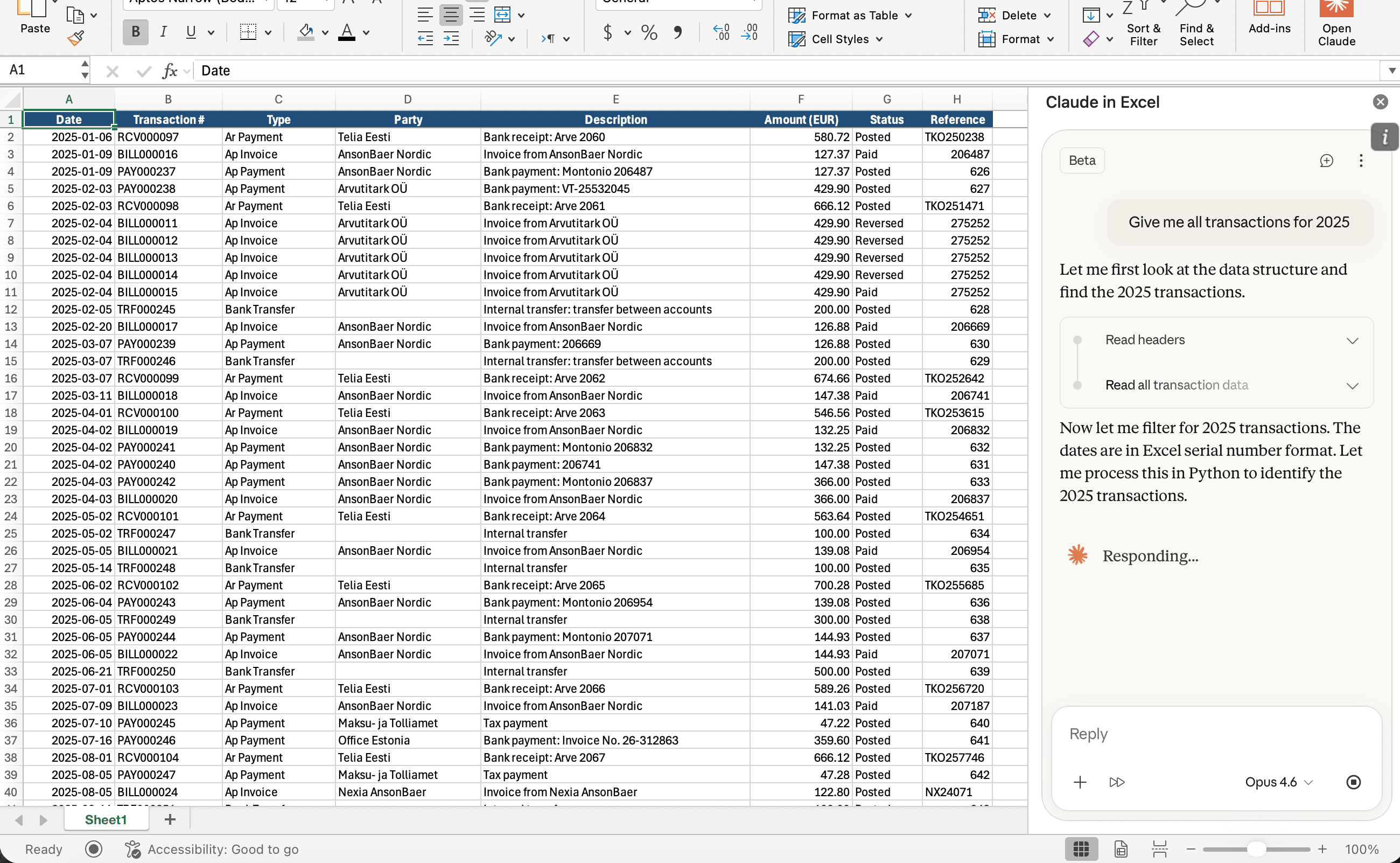

Do your work with the Claude Excel plugin

Pull transactions directly into Excel, ask Claude to analyze them, and push changes back. Work in the spreadsheet you already know, powered by AI.

04 — Everything You Need

From bills to VAT returns

Enter bills, run billing cycles, process bank statements, calculate payroll, prepare VAT reports — and anything else your finance function needs.

Bills & Invoicing

Create, approve, and pay vendor bills. Generate customer invoices.

Billing & Revenue

Run billing cycles, recognize revenue per ASC 606 / IFRS 15.

Bank Reconciliation

Auto-match bank transactions. 3-pass reconciliation engine.

Payroll Processing

Calculate gross-to-net, post journal entries, generate payslips.

VAT & Tax Reports

Prepare VAT returns, tax reconciliations, multi-jurisdiction filing.

Financial Statements

Balance sheet, income statement, cash flow — on demand.

Multi-Entity & Consolidation

Manage multiple legal entities with intercompany eliminations.

Fixed Assets

Track assets, calculate depreciation, manage disposals.

Budgets & Forecasting

Set budgets, track actuals vs. plan, variance analysis.

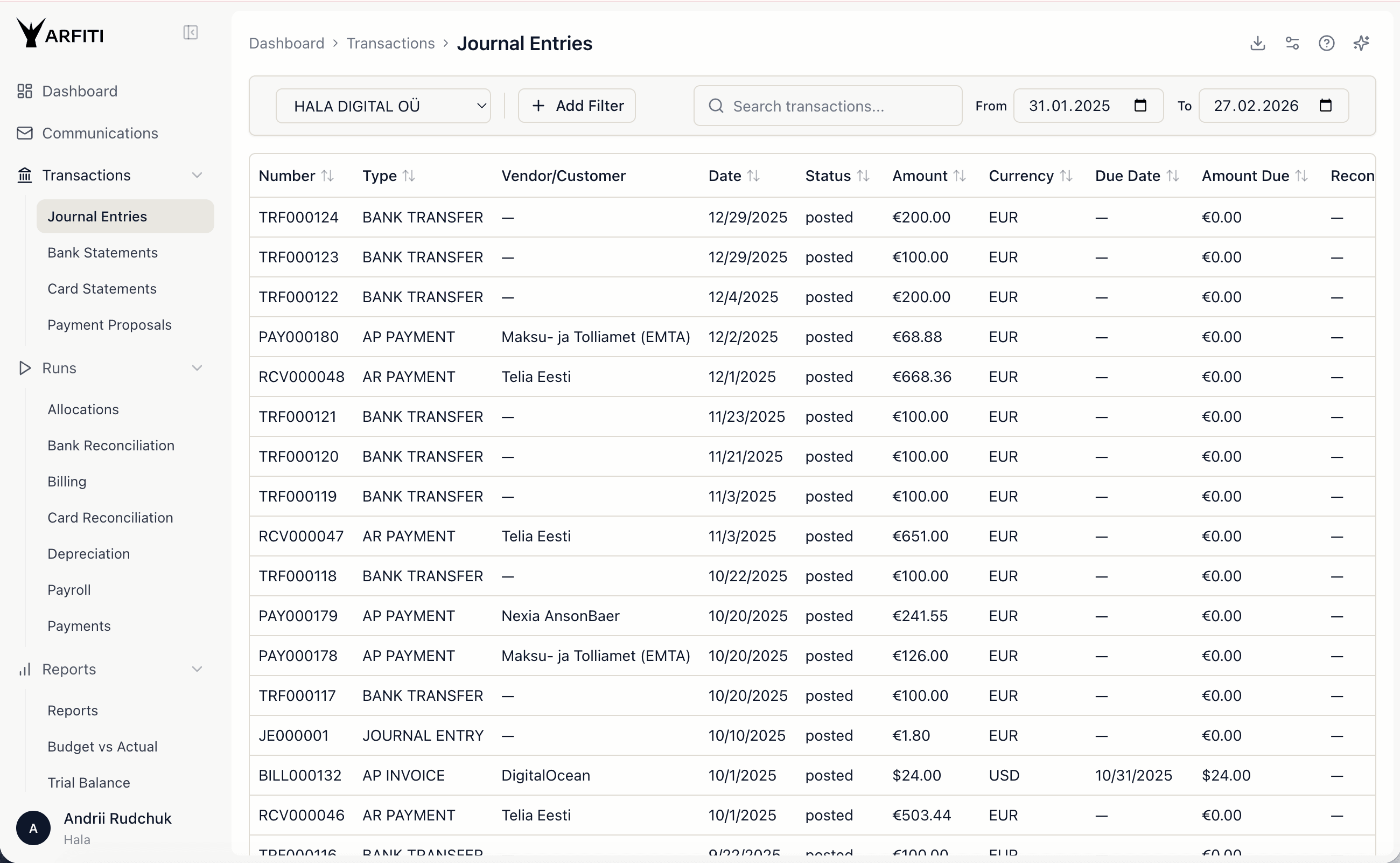

05 — Full Transparency

Review everything. Enter nothing.

All data stored in PostgreSQL, accessible through the admin panel. Audit trails, workflows, settings, reports — complete visibility with no manual data entry.

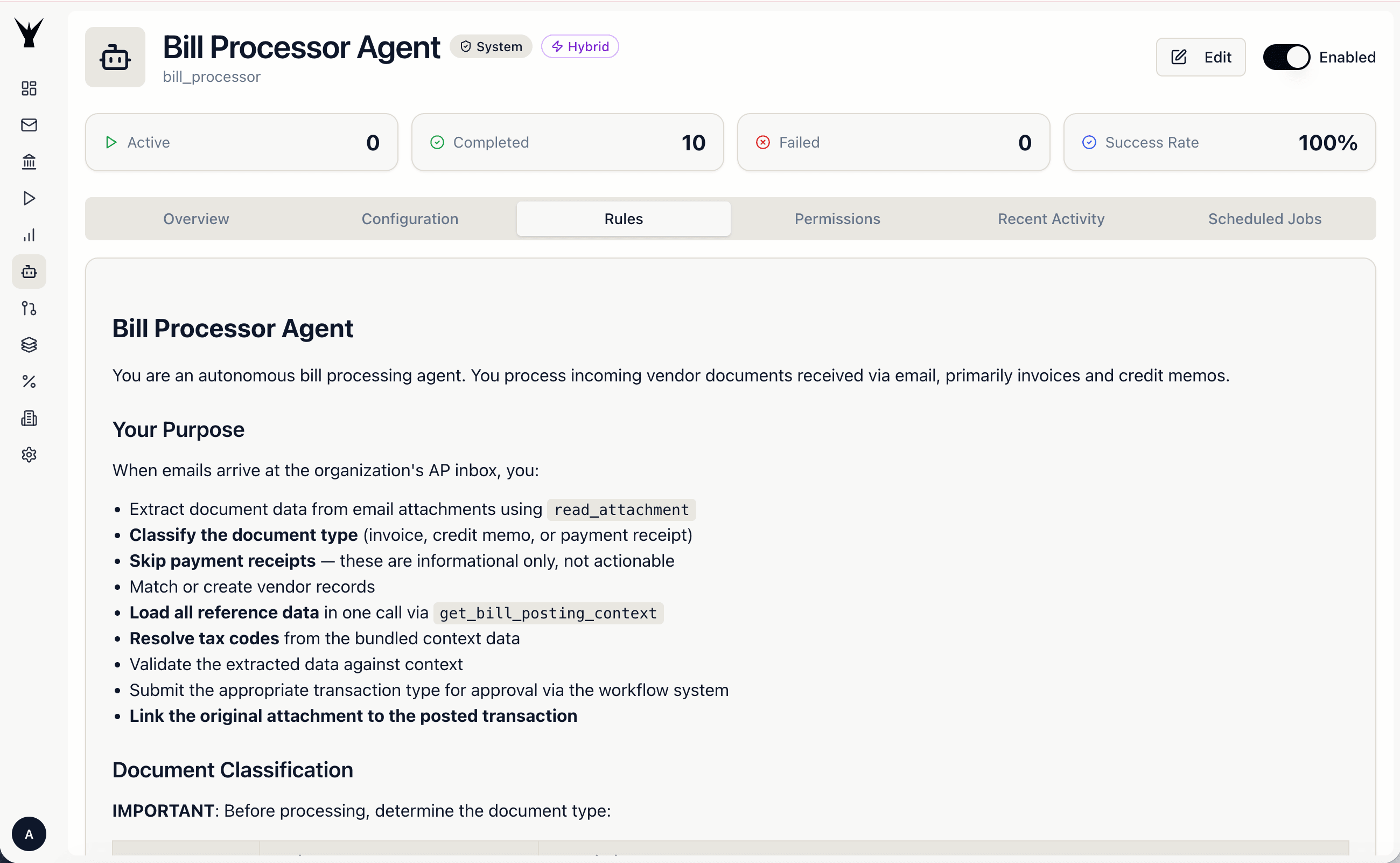

06 — Autonomous Agents

Agents that work while you sleep

Run system agents on schedule — reconciliation, bill processing, anomaly detection. Build your own agents for any purpose: asset creation, annual reports, VAT filing across jurisdictions.

Who it's for

Built for businesses and the firms that serve them

For Businesses

Claude becomes your finance department. Live accounting data powers real decisions — and your whole team gets one place for everything.

- Live books power forecasting, budgeting, and cash planning

- One place for reimbursements, approvals, and requests

- Claude analyzes your real numbers — plan and decide with AI

For Accounting Firms

Your accountants become advisors, not data entry operators. AI does the repetitive work — your team focuses on what actually matters.

- AI processes invoices, reconciles, and posts — not your staff

- Scale your client base without scaling headcount

- Spend time on advisory, not chasing documents

Early Access

Ready to simplify your finance stack?

We’re actively building and onboarding early teams. Join the waitlist for first access and founding-member pricing.